What is Accounts Payable?: Definition, Process & Examples

What is Accounts Payable?

The accounts payable is refers to the money that a company owes to a vendor or a supplier – for having availed of their products or services.

When a company buys products or services from a vendor with an arrangement to pay later, the amount is called the accounts payable - until the payment is made. It is a form of credit offered by the vendor or supplier.

The account payable is recorded when an invoice is approved for payment. It’s recorded in the General Ledger (or AP sub-ledger) as an outstanding payment or liability until the amount is paid. The sum of all outstanding payments is recorded as the balance of accounts payable on the company’s balance sheet. The increase or decrease in total AP from the previous period will be recorded in the cash flow statement.

Companies closely monitor their AP processes to prevent fraud, ensure timely payments and maintain overall financial health.

Examples of accounts payable expenses

Here are a few examples of accounts payable expenses:

- Goods & raw materials

- Office maintenance & Stationery

- Transportation & Logistics

- Power / Energy / Fuel

- Equipment

- Leasing

- Licensing

- Services

- Software

What does the AP department do?

The accounts payable department manages the entire AP process playing a vital supporting role to the accounting department. The AP team is responsible for receiving, verifying, coding, approving, paying and reconciling vendor invoices.

A well organized AP department can help companies save money and time. AP professionals follow a number of accounts payable best practices. For instance, they closely review vendor invoices to ensure that payments are legitimate - thus preventing fraudulent or incorrect payments. They also focus on paying invoices on time to avoid late fees, penalties or strained vendor relationships.

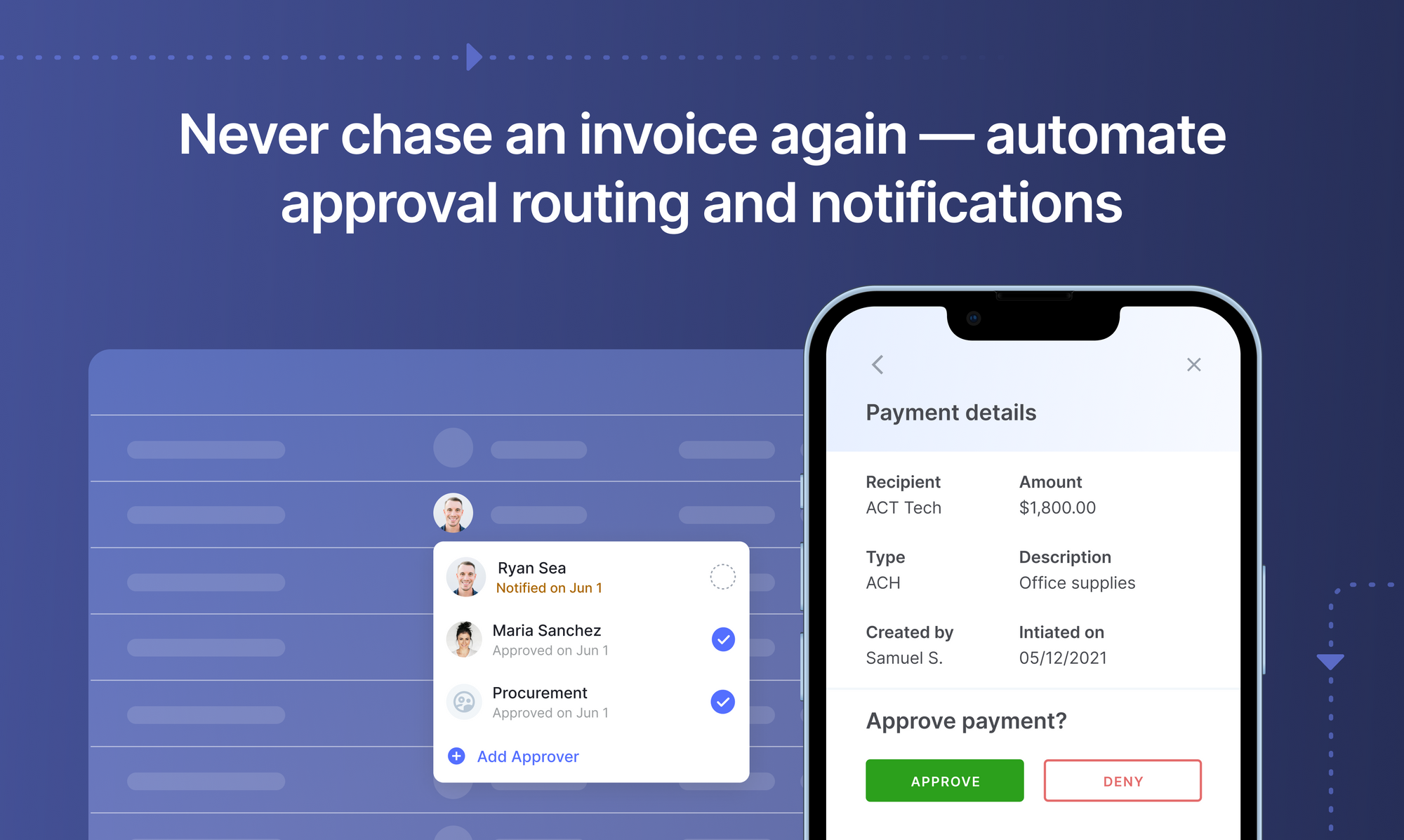

Modern AP teams are turning to automation to further optimize the accounts payable process. AP automation allows AP teams to review, approve & pay invoices almost instantly. Clearing payments in an appropriate schedule helps accounts payable departments to earn discounts and control cash outflow.

This allows the AP staff to focus on higher value activities that contribute to the companies bottom line.

Automate data capture, build workflows and streamline the Accounts Payable process in seconds. No code required. Book a 30-min live demo now. Automate invoice payments with AI.

The accounts payable process

The AP workflow begins when a vendor/supplier submits a bill requesting payment. The accounts payable department then verifies said bill or invoice and codes it accordingly into the general ledger (GL coding).

A further level of internal scrutiny might involve a 2 way or 3 way match of the invoice against supporting documents. The invoice then goes for internal approvals and is finally processed for payment upon final AP approval.

The full cycle of the accounts payable process can be summarized in the following steps:

- receiving and capturing invoice data

- appropriate GL coding

- a 3 way match of invoices

- approving or flagging invoices

- and finally processing payments.

Accounts payable department - roles & responsibilities

Accounts payable is an extremely critical finance function. It oversees a significant portion of cash outflow and also impacts the bottom line to a large extent.

Each member of an AP team play a crucial role in the AP process. The AP team consists of multiple roles such as:

- The data entry analyst inputs the invoices into the digital system once they are received.

- The payment processing analyst is in charge of paying invoices on the date in which they are due

- The exceptions analyst addresses discrepancies in invoices and handles payment failure issues.

- The vendor management personnel create and manage the supplier database and correlate it with various procurement operations.

- The Accounts Payable manager coordinates with the team for error-free and seamless invoice management.

All members of the team work towards creating and maintaining strong supplier relationships. The team must also keep a close watch on accounts payable expenditures and maintain internal controls to protect cash outflow.

AP professionals in small businesses often handle multiple roles and juggle many responsibilities simultaneously. Here are some of the common responsibilities handled by accounts payable:

- Collecting, maintaining, verifying, recording and sharing business transactions.

- Flagging invoices or transactions.

- Getting requisite approvals or signatures for particular transactions

- Creating a paper trail for each payment and reconciling bank statements.

- Veryfing invoices and payments by matching them or reconciling them with supporting documents.

- Review line items and totals on invoices to prevent fraud, errors & double payments.

- Keeping track of master vendor data, assigning voucher numbers, and maintaining vendor correspondences.

- Communicate accounting and spend policies with the company and large.

- Prepare a system of checks and balances.

An efficient and well-managed accounts payable workflow can save companies considerable amounts of time and money with regard to accounts payable. Organizations, on rare occasions, also outsource AP functions to external agencies.

Manual AP processes vs. AP automation

Traditionally AP processes have largely been manual.

Despite the buzz surrounding automation, a PYMNTS.com survey showed 80% of firms still use manual paper checks. Another survey by IDC showed that 64% of respondents relied on spreadsheets to manage their payment processes!

Thousands of accounts payable teams still collect documents, enter data into accounting or ERP software, match & verify data, get approvals from colleagues and process payments – all done manually!

Manual accounts payable tasks are time-consuming, resource-intensive and inefficient, apart from being highly error-prone. The lack of visibility manual AP processes expose it to fraud and security vulnerabilities.

Manual oversight and mistakes can result in late payments, unhappy suppliers and affect credit ratings. And as a company grows in size, the volume of data just becomes a nightmare to handle.

Manual tasks mostly involve data entry and data verification/matching which are pretty low-value – the mundane, repetitive nature of these tasks leads to work dissatisfaction and employee turnover.

Modern AP teams that switch to AP automation manage these low-value tasks on auto-pilot. They focus instead on higher value tasks such as defining internal controls, lobbying for optimal credit terms and discounts from suppliers, framing spend policies and being accounts payable audit-ready.

Automate bill pay with Nanonets

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

How to Record Accounts Payable

Recording accounts payable is an essential process in accounting, facilitating the accurate management of business transactions. Here's a comprehensive overview of how to record accounts payable effectively:

Accounts payable entries involve the following steps:

- Debit the Relevant Expense or Asset Account:

- Debit the asset or expense account associated with the purchase, whether it involves acquiring inventory, services, or other items.

- Credit the Accounts Payable Account:

- Credit the accounts payable account to represent the outstanding amount owed to the supplier or vendor.

When the accounts payable is settled:

- Debit the Accounts Payable Account:

- Debit the accounts payable account to reflect the reduction in the payable balance as the payment is made.

- Credit the Cash or Bank Account:

- Credit the cash or bank account to account for the outgoing payment made to the creditor.

Accounts payable is a vital component of a company's balance sheet, categorized under "current liabilities" as it represents the short-term obligations to creditors, typically spanning less than 90 days. Maintaining accurate accounts payable records is crucial for ensuring financial transparency and stability within a business.

Key Performance Indicators (KPIs) for accounts payable

Businesses can use KPIs to measure the effectiveness and efficiency of their accounts payable department, identify areas that require improvement, and track progress. Here are some crucial KPIs for accounts payable:

Cost per invoice processed: This measures the total cost of processing an invoice by dividing the total AP department costs by the number of invoices processed.

Invoice processing time: This measures the time it takes to process an invoice, revealing inefficiencies in the process.

Percentage of invoices paid on time: This measures the efficiency of the AP department in making payments within the stipulated credit period.

Percentage of duplicate payments: This identifies the percentage of payments made twice to the same invoice.

Percentage of invoices processed electronically: This measures the degree of process automation within the AP department.

Percentage of supplier disputes: This measures the number of supplier disputes as a percentage of total invoices.

Invoice exception rate: This measures the percentage of invoices that require additional attention due to discrepancies or errors.

Days payable outstanding (DPO): This calculates the average time it takes for a company to pay its bills and invoices.

Percentage of manual checks: This measures the degree to which the company still relies on manual payment processes.

Vendor satisfaction rate: This gauges the overall satisfaction of vendors with the payment process.

Regular tracking and analysis of these KPIs can provide valuable insights into the functioning of the AP department, pinpoint areas of concern, and highlight opportunities for improvement. These metrics allow businesses to streamline their AP processes, reduce errors, and improve vendor relationships.

The impact of accounts payable on cash flow

Cash flow is the lifeblood of any business, and how accounts payable are managed can have a significant impact on a company's cash flow.

Accounts payable represents the money a company owes to its suppliers or vendors for goods or services received. This is a liability for the company and must be managed well to ensure smooth operations and maintain good relationships with vendors.

If accounts payable are not managed properly, it can lead to cash flow problems. For instance, if a company pays its bills too soon, it may not have enough cash to meet other financial obligations. On the other hand, if it delays payments too much, it could damage its relationship with suppliers and potentially face penalties or disruptions in supply.

Therefore, a well-managed accounts payable process is crucial for maintaining a healthy cash flow. This involves:

- Accounts payable reports for the accurate and timely reporting of all payable amounts.

- Negotiating favorable payment terms with vendors.

- Implementing a system to avoid late payments and potential penalties.

- Prioritizing payments based on the vendor's importance and the delayed payment cost.

- Using technology to automate and streamline the accounts payable process.

By managing accounts payable effectively, a company can optimize its cash flow, maintain good vendor relationships, and ensure financial stability. It also allows the company to take advantage of early payment discounts, avoid late payment penalties, and enhance its creditworthiness.

The accounts payable process, when automated, can provide real-time visibility into the company's liabilities, enabling better cash flow management and decision-making.

Why automate accounts payable?

All companies, whether big or small, receive vendor invoices and process payments. Every company reaches a point where trade payable activities can no longer be carried out manually.

Apart from being inefficient they just get too expensive. Studies show that it can cost anywhere between $12-40 to just process an invoice manually. Add payments to the mix and the cost goes up by another $5.

Accounts payable automation solutions or invoice processing software like Nanonets help companies process their payables accurately at a fraction of that cost. AP automation also helps save time & valuable resources that could be directed elsewhere.

Efficient AP software such as Nanonets can enable better procure-to-pay processes, ensure tax compliance, automate 3-way matching, optimize AP days or DPO, prevent fraud, streamline cash flows, maintain vendor relationships and store data for posterity. Digitally enabling the AP process would advance business strategies by turning vendor-client relationships into a competitive advantage.

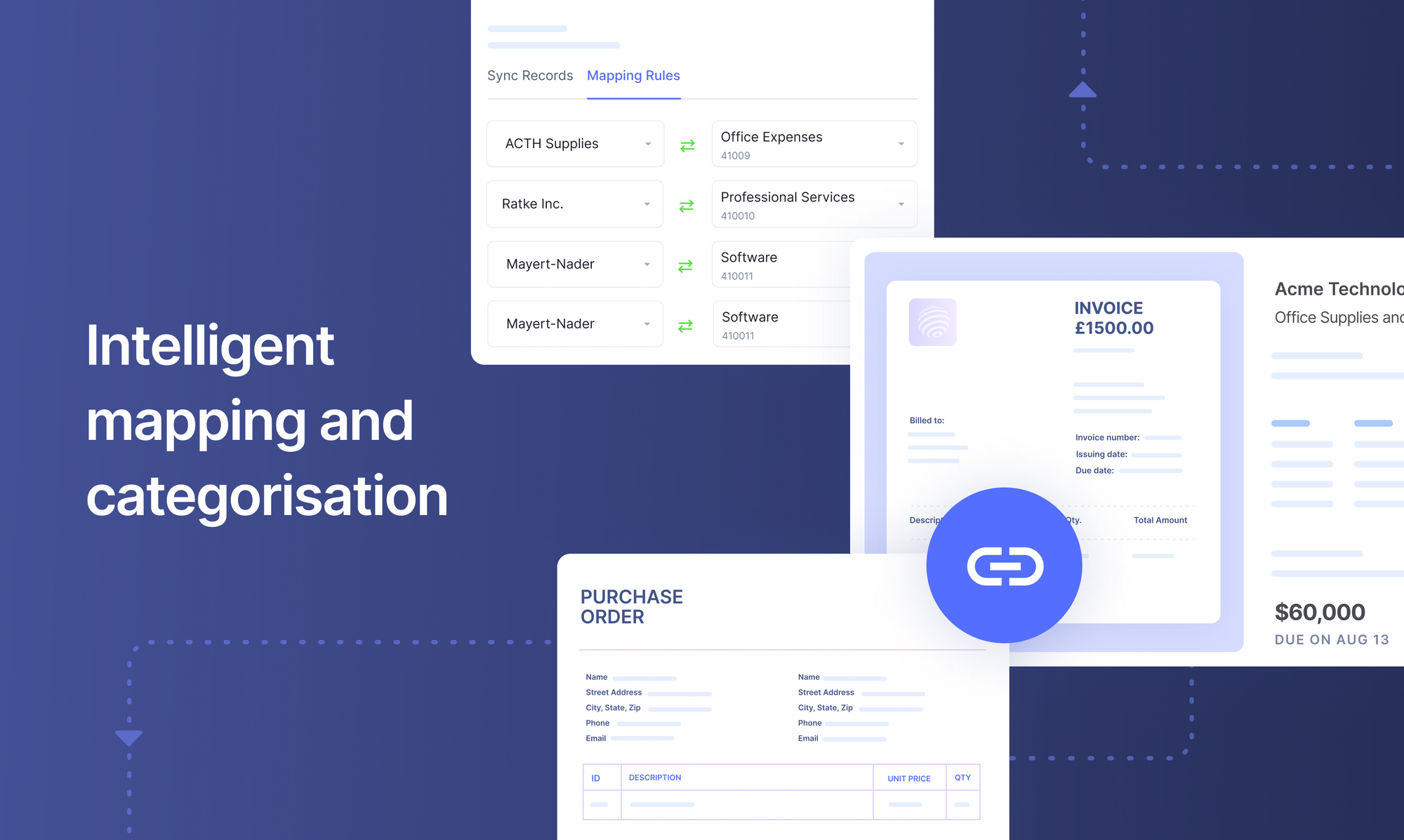

Nanonets offers end-to-end accounts payable automation through Flow, a platform that automates all the key processes within accounts payable:

1. Invoice data entry

2. Spend approval and review

3. Vendor payments

Flow uses state-of-the-art AI to streamline every step of the AP process, ensuring that growing businesses don't waste valuable time on manual tasks.

Flow also comes with enterprise-grade security standards and financial controls, ensuring that your AP function's efficiency keeps going up as the business scales.

Accounts payable FAQs

What is accounts payable?

The accounts payable is an accounting term that refers to the money that a company owes to a vendor or a supplier – for having availed of their products or services. Accounts payable refers to a department and a job.

Are accounts payable debit or credit?

To answer the question, accounts payable are considered to be a type of liability account. This means that when money is owed to someone, it is considered to be credit. Learn more here.

How are accounts payable recorded on a balance sheets?

Since AP is considered a liability, it is listed under current liabilities on the balance sheet.

What’s the difference between accounts payable & accounts receivable?

Accounts payable is the money that your business owes to suppliers or vendors. Accounts receivable is the money that your customers owe to your business. The former represents outflows of cash while the latter describes inflows. Also, explore difference between accounts payable and notes payable.

What is an accounts payable turnover ratio?

A company's short-term liquidity may be evaluated by calculating a ratio known as accounts payable turnover. This ratio represents the average pace at which a business pays back its suppliers. The accounts payable turnover ratio is a statistic businesses use to gauge how well they are clearing off their short-term debt.

The following is the formula to calculate the accounts payable turnover ratio:

Payable Turnover Ratio = Net Credit Purchases/Average Accounts Payable

What are the 4 functions of accounts payable?

The four main functions of the accounts payable department are:

- Receive, process, and verify invoices

- Authorize and schedule payments to vendors

- Maintain accurate records of transactions

- Manage vendor relationships (negotiate payment terms, resolve disputes, ensure timely payments)

Which type of account is accounts payable?

Accounts payable is considered a current liability account. This means it's an obligation the company must pay off within the next year. Just like other liability accounts, accounts payable increases with a credit entry. When the company pays off the payables, it debits accounts payable. This type of account is crucial in managing cash flow and maintaining good relationships with suppliers.

What are the controls in AP?

AP controls are standardized procedures used by companies to reduce risks and ensure compliance in their accounts payable workflow. The controls are grouped into three categories: obligation to pay, data entry, and payment controls.

Examples of controls in each category include invoice approval, purchase order approval, three-way matching, vendor master data management, and segregation of duties. These controls help in detecting errors and fraud, ensuring accurate and timely payments, and maintaining a clean audit trail.

How to calculate accounts payable?

If a business starts the year with $5,000 in accounts payable, makes $20,000 in credit purchases throughout the year, and makes payments of $15,000 to suppliers, the ending accounts payable would be:

Ending Accounts Payable = ($5,000 + $20,000) - $15,000

This means that the business has $10,000 in outstanding payables at the end of the year. Keeping track of this number helps businesses manage their cash flow and ensure they're meeting their obligations to suppliers.

.png)

.png)

.png)

.png)